Option Development and Packaging

This chapter summarises the option development and packaging and additional sift that has been undertaken based upon the preliminary appraisal and results of a stakeholder workshop to identify any further unintended consequences

Unintended Consequences

During the preliminary appraisal process, a workshop was undertaken to build upon the understanding of possible impacts of any potential TDM options in terms of:

- Communities of place (urban/rural, remote, island).

- Communities of interest (protected characteristics, socioeconomic disadvantage).

- Impacts on business and the wider economy.

- Intersectionality – a concentration of impacts based on convergence of multiple social and environmental determinants.

- Public Acceptability.

- Environmental impacts.

A variety of Scottish Government and external stakeholders representing the interests of local government, taxation, health, accessibility, freight and logistics, a just transition, public transport and the low carbon economy attended the session. Key questions asked during the workshop were:

- Who? Identify populations which may be affected by implementation of the option.

- What? Identify potential impacts which may unintentionally result from the measure.

- How? Establish the causal link between the two.

- Can positive impacts be maximised and negative impacts mitigated?

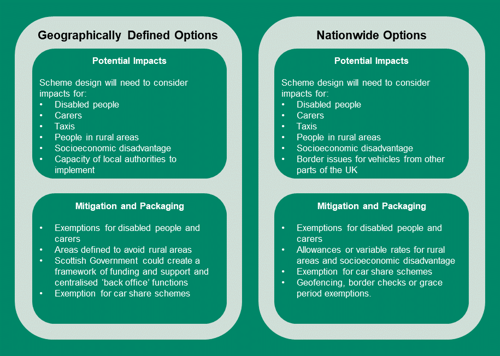

For the purposes of the workshop, the options retained from preliminary appraisal were placed into two broad categories:

- Geographically Defined Options: Cordon and Area Based Charges.

- Nationwide Options: Distance Charging.

The findings from the workshop are presented in Figure 4‑1.

Option Refinement and Definition

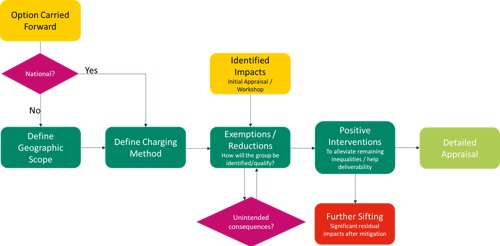

The options taken forward from Preliminary Appraisal were further refined in line with the findings of the unintended consequences workshop. For each option, suitable mitigations for identified unintended consequences were applied as iterative sensitivity tests to refine the option. Where significant residual impacts persisted after mitigation, the option was sifted out. Wider complementary measures, such as recommendations from STPR2, were not explicitly considered. Figure 4‑2 below sets out this iterative process.

Packaging

A number of options were considered for taking forward to detailed appraisal. They consist of the two Geographically Defined Options (Cordon and Area) and five possible options for implementing distance charging. The possible options for distance charging, and rationale for an additional sift are shown in Table 4‑1 below.

|

Option |

Description |

Sifting Rationale |

|

Flat Rate, No Allowance |

Fixed flat rate per kilometre |

Sift out – Inequitable – significant disadvantage to rural poor populations |

|

Flat Rate, Fixed Allowance |

Fixed allowance of free kilometres per vehicle, Fixed flat rate per kilometre above allowance |

Sift out – Inequitable - significant disadvantage to rural poor populations |

|

Flat Rate, Variable Allowance |

Variable allowance of free kilometres per vehicle, determined by owner’s/registered keeper’s income and geographical location, Fixed flat rate per kilometre above allowance |

Retain |

|

Flat Rate, Individual Allowance |

Variable allowance of free kilometres per individual, determined by income and geographical location, Fixed flat rate per kilometre above allowance |

Sift out – Undeliverable – administrative burden of charging/applying allowance to a person as opposed to a vehicle. |

|

Geographically Variable Rate |

Variable rate applied based on vehicle owner/registered keeper characteristics and time/location of journey. |

Retain |

Options Taken Forward

The options identified for detailed appraisal are outline below under two broad categories:

- Those which would be applied on a local basis, over a geographically defined area and implemented by local authorities.

- Those that would be applied on a national basis and implemented by the Scottish Government.

The two broad approaches are not mutually exclusive and could be run concurrently but administered separately. However, employing both approaches could lead to drivers being charged twice, unless a more technological approach were employed which ensured interoperability. An overview of the potential for each option to reduce car kilometres, reduce greenhouse gas (GHG) emission and generate revenue is presented in Table 5‑1 in section 5.

The option descriptions that follow are presented under the following headings:

- Option as modelled – describing the option explicitly represented by the model outputs, including specific assumptions in regard to the discounts and exemptions to the charging scheme.

- Additional considerations – describing the measures that are considered essential to delivering a scheme in practical terms.

In order to maintain consistency with the car kilometre reduction target and route map, all options have been appraised in kilometre units. However, in practical terms, it is recognised that these units would need to be quoted in miles for any scheme that is taken forward.

Cordon-Based

Option as modelled: A charge applied per day for crossing a boundary into or out of large urban areas as defined by the Scottish Government 6-fold Classification including Glasgow, the upper Clyde Valley, Edinburgh, Aberdeen and Dundee, as shown in Figure 4‑3. As current legislation precludes local schemes from being applied to trunk roads, these have been excluded from the zone, with off-slips modelled as a zone entry. A discounted rate applies to those in the lowest 20% income group within "remote rural" areas only. An exemption would also be applied for people with a disability affecting their mobility, as indicated by membership of the blue badge scheme. This assessment has assumed a proportion of exemptions based on the number of blue badge holders in the population and has applied this to the trip making characteristics of those answering ‘yes’ to the question: Does your condition or illness reduce your ability to carry-out day-to-day activities? in the Scottish Household Survey.

Additional considerations: To ensure that possible boundary effects are avoided, the option would be likely to require accompanying parking charges at boundaries. The time of day that charging would apply could also mitigate against negative effects potentially encountered by shift workers. Car share schemes would be exempt and could provide access to a car for those in socioeconomically disadvantaged areas. Cordon-based schemes, such as those already implemented in greater London, are typically enforced and operated by Local Authorities, using existing powers and likely implemented by ANPR technology. Existing legislation states net proceeds should be used to support objectives of the local transport plan

Area-Based

Option as modelled: A daily charge applied for driving into or within large urban areas as defined in Figure 4‑3 and including Glasgow, the upper Clyde Valley, Edinburgh, Aberdeen and Dundee. As current legislation precludes local schemes from applying to trunk roads, these have been excluded from the zone, with off-slips modelled as a zone entry. A discounted rate would be applied to of the lowest income group within "remote rural" areas only. An exemption would be applied for people with a disability affecting their mobility, as indicated by membership of the blue badge scheme.

Additional considerations: To ensure that possible boundary effects are avoided, the option would be likely to require accompanying parking charges at boundaries. The time of day that charging would apply could also mitigate against negative effects potentially encountered by shift workers. Car share schemes would be exempt and could provide access to a car for those in socioeconomically disadvantaged areas. Existing legislation states net proceeds should be used to support objectives of the local transport plan

Distance (Geographically Variable Rate)

Option as modelled: A rate applied per kilometre travelled which is discounted for those in the lowest income group and living within “remote rural” areas only – as shown in Figure 4‑3. An exemption would be applied for people with a disability affecting their mobility, as indicated by membership of the blue badge scheme.

Additional considerations: The option would be accompanied by geofencing or a grace period exemption for vehicles from out with Scotland. Second cars could incur a higher rate and there would be potential for vehicle allowances to be traded. The use of GNSS technology could allow for the rate to vary by vehicle location and time of journey. Allowances or lower rates could also be applied to car share schemes in order to provide greater access to those on lower incomes. Revenues generated from a national distance-based scheme could be hypothecated to national transport portfolios, such as those set out in the Strategic Transport Projects Review 2 (STPR2), and in line with the sustainable investment hierarchy.

Distance (Flat Rate, Variable Allowance)

Option as modelled: The indicative car kilometre and carbon emission reduction, and revenue raising potential, has been modelled using the same assumptions as the Distance (Geographically Variable Rate) option. This variation of distance-based charging is implemented as a relatively high fixed rate applied per kilometre travelled nationwide with a variable yearly free allowance of kilometres defined by income group and geographical location. A greater allowance would be applied to the lowest income group within "remote rural" areas only – as shown in Figure 4‑3. An exemption would be applied for people with a disability affecting their mobility, as indicated by membership of the blue badge scheme.

Additional considerations: The option would be accompanied by geofencing or a grace period exemption for vehicles from outwith Scotland. Allowances would not be provided for second cars and there would be potential for vehicle allowances to be traded. Additional allowances could also be applied to car share schemes in order to provide greater access to those on lower incomes. Revenues generated from a national distance-based scheme could be hypothecated to national transport portfolios, such as those set out in the Strategic Transport Projects Review 2 (STPR2), and in line with the sustainable investment hierarchy.